Report: Employee financial stress is rising

We surveyed 815 employed Wealthsimple clients and heard how they feel about their current financial situations and the role their employers play.

June 4, 2025

We surveyed 815 Wealthsimple clients who were employed either part or full-time and asked them how they were feeling about their finances.

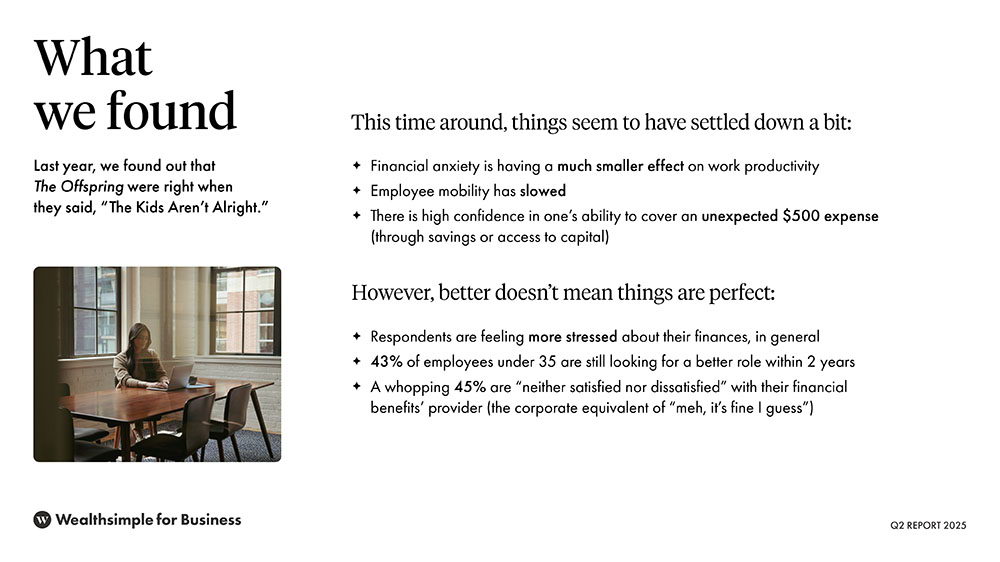

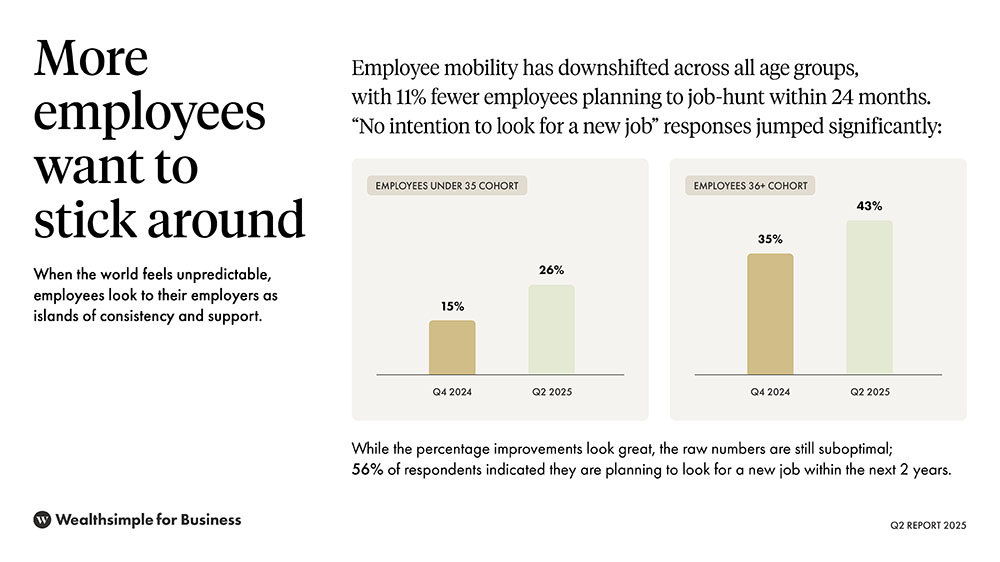

What we found was a mix of bad and good. Like how employees are reporting increased financial stress (bad), but lower intent to change jobs (good). Or how there is a higher dissatisfaction with the amount being saved (bad), but a high level of confidence to cover an unexpected $500 cost (good).

We compared this research to our last report and found some interest trends! Grab the full report below and see how you could implement some of this data into your financial wellness program.

By filling out this form, you provide your consent that Wealthsimple for Business may contact you with marketing, product, or promotional materials. You are welcome to unsubscribe at any time! Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Report sneak peak

Here are a few screen grabs from the report and what you can expect:

Our Wealthsimple for Business product is offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Assets in your Wealthsimple for Business account are held in an account with Wealthsimple Inc.‘s affiliated custodial broker, Wealthsimple Investments Inc. (WSII). WSII is a member of the Canadian Investment Regulatory Organization (CIRO). Customer accounts held at WSII are protected by Canadian Investor Protection Fund (CIPF) within specified limits in the event WSII becomes insolvent. A brochure describing the nature and limits of coverage is available upon request or at CIPF. Wealthsimple Inc. is not a member of CIRO nor a member of CIPF.