Wealthsimple Vanguard Target Date Portfolios: Retirement investing on your schedule

Powered by Vanguard investment solutions, Target Date Portfolios take the complexity out of investing for retirement.

November 4, 2025

Planning for retirement is one of those things everyone knows they should do, but the “how” can feel overwhelming. Should you be aggressive? Conservative? Somewhere in the middle? Do you change your strategy as retirement gets closer? When should you do that?

To help answer these questions and give retirement-focused investors peace of mind, we’re very excited to introduce Wealthsimple Vanguard® Target Date Portfolios (“TDPs”). And yes, we’re talking about that Vanguard. The global organization with over 50 years of proven expertise in pioneering low-cost, index ETFs. Part of their mission is to provide accessible investment options that help everyday investors achieve their financial goals.

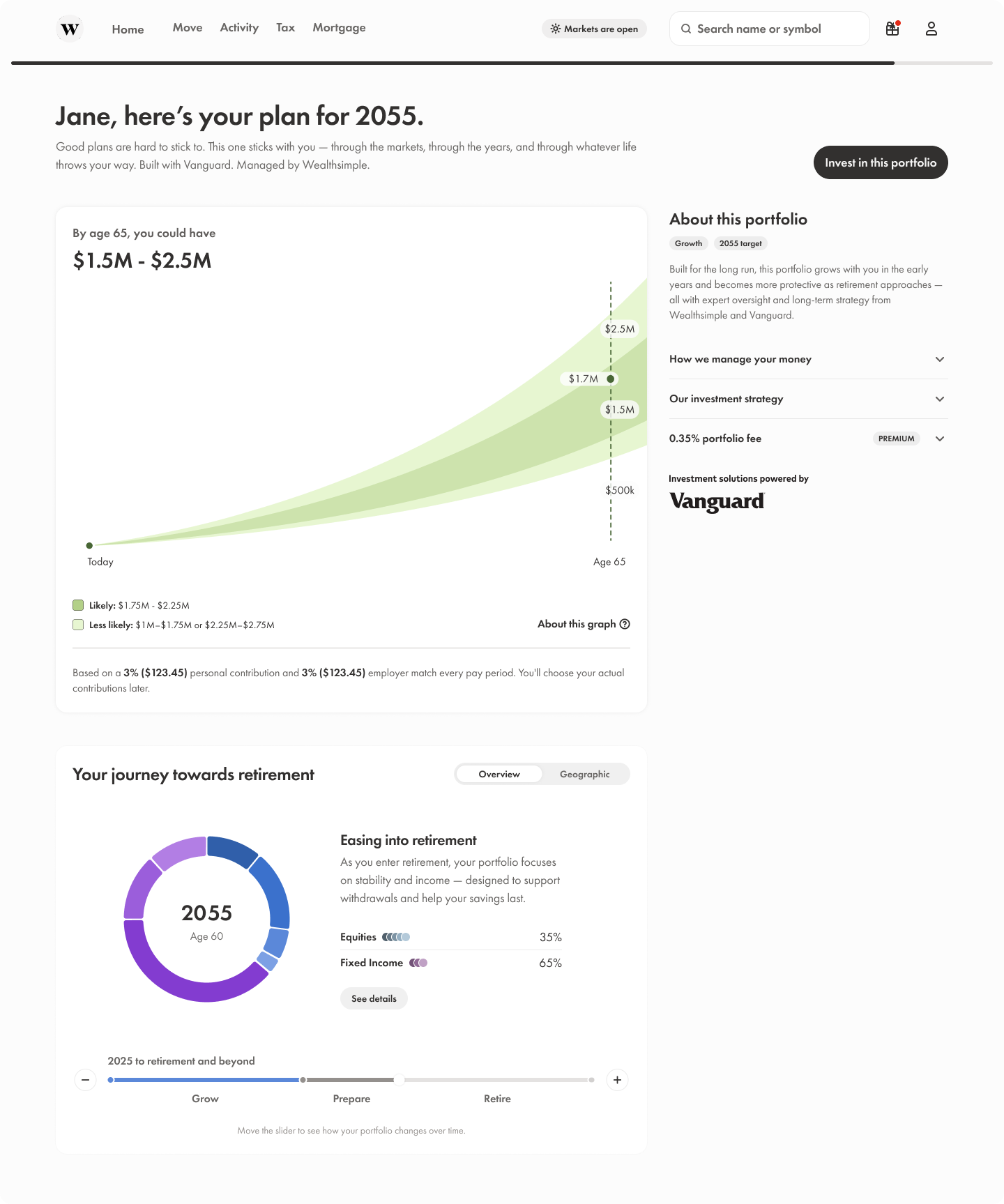

These professionally managed portfolios are built to automatically adjust as you move through life and retirement. They’re designed for people who want retirement savings to be straightforward, transparent, and low-cost, without compromising quality and long-term gains.

The old way vs. the new way

Traditional retirement funds often come with high fees, layers of hidden costs, and limited transparency. You don’t always know what you actually own or how your money is being managed.

With Wealthsimple Vanguard TDPs, we’ve built a solution that fixes those problems:

- Lower, predictable fees: no expensive mutual fund layers, just low-cost ETFs that are generally cheaper than comparable retail products.

- Transparency at every step: you directly own the underlying ETFs, with every trade and holding visible in real-time.

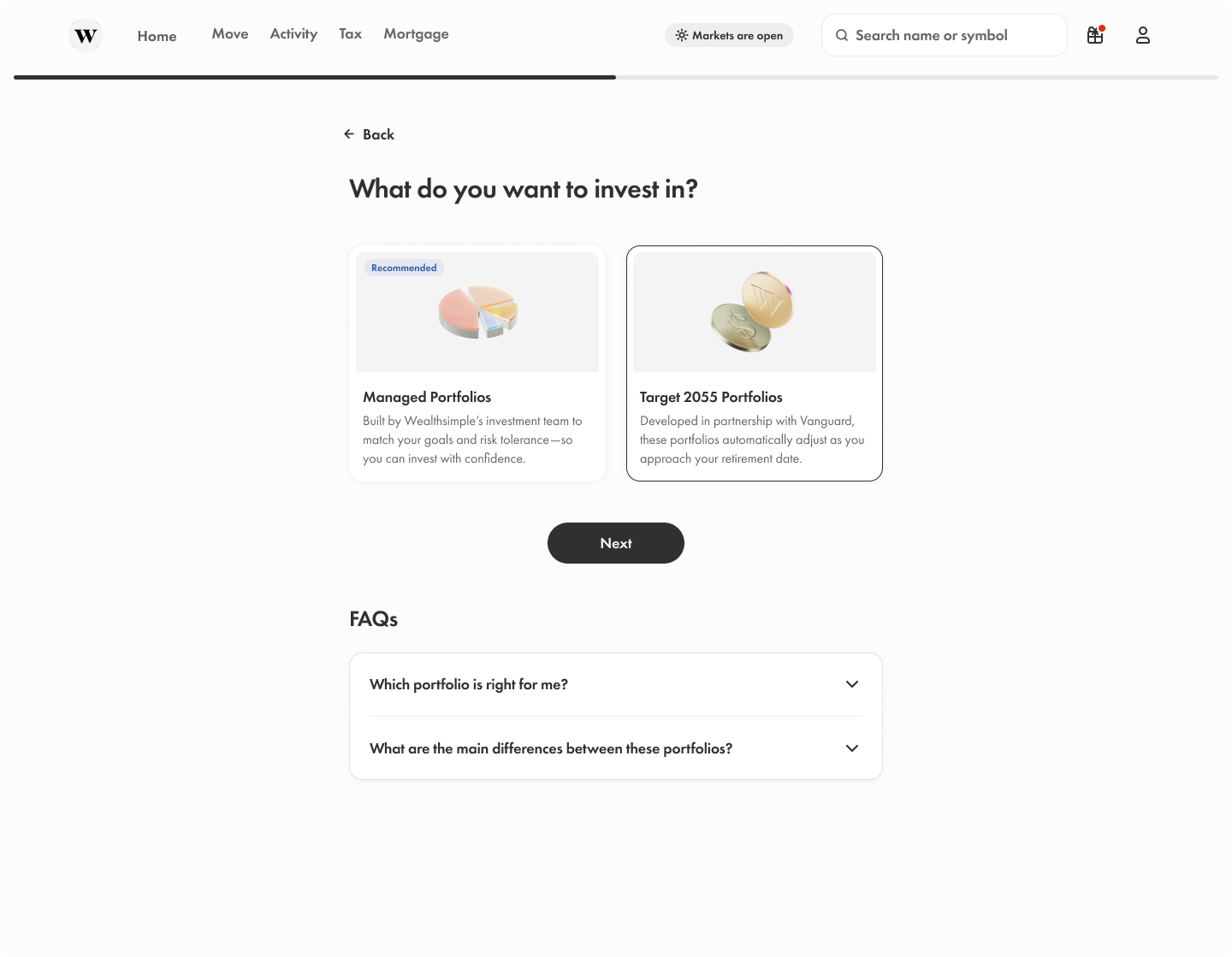

- Tailored fit: a simple suitability process matches you to the right portfolio, factoring in both your age, when you plan to retire, and risk tolerance.

- Automatic adjustments: your portfolio shifts gradually from growth to stability as your retirement date approaches.

How it works

The first step is a crucial one, your company must be working with Wealthsimple and set up a group plan for you and your team. Reach out to the team here if that’s not the case today!

Importantly, these Target Date Portfolios are only available to investors whose goal is retirement as this is where the target date investment strategy can be the most effective. You would typically use a Group RRSP or Deferred Profit Sharing Plan (DPSP) to focus on retirement and realize the benefits of the TDPs.

Even with TDPs, we ask every investor to answer a short suitability questionnaire to determine their risk profile.

Finally, you are placed in the Target Date Portfolio that matches your expected retirement timeline and your risk tolerance.

Next? Sit back and relax. The portfolio evolves automatically, aiming to reduce risk as you near retirement.

Why this matters for Canadians

Most workplace retirement plans in Canada still lean on pricier investment funds. The Wealthsimple Vanguard Target Date Portfolios aim to change that. With this solution, employers and employees alike can access a world-class, low-cost retirement solution through Wealthsimple for Business.

The goal? To make retirement saving as easy as “set it and forget it”, meaning more Canadians can save and retire with confidence.

Where to access these portfolios

Wealthsimple Vanguard Target Date Portfolios are available exclusively through the Wealthsimple for Business group investing platform. Companies who enable these portfolios for their group plans will see them as an option when opening or managing their accounts where retirement is the goal.

Looking ahead

This is just the first step of the Wealthsimple and Vanguard partnership. Together, we’re building not just Target Date Portfolios, but a future where high-quality, low-cost investment options are accessible to every Canadian.

Vanguard is a trademark of The Vanguard Group, Inc., used under licence.